A Biased View of Pvm Accounting

A Biased View of Pvm Accounting

Blog Article

Not known Incorrect Statements About Pvm Accounting

Table of ContentsThe Of Pvm AccountingThe Greatest Guide To Pvm AccountingPvm Accounting - TruthsThe Single Strategy To Use For Pvm AccountingExamine This Report on Pvm AccountingThings about Pvm Accounting

Guarantee that the audit procedure complies with the law. Apply called for building and construction accounting requirements and treatments to the recording and reporting of building and construction task.Interact with various funding firms (i.e. Title Firm, Escrow Company) relating to the pay application process and requirements needed for repayment. Help with applying and keeping interior economic controls and treatments.

The above declarations are meant to explain the general nature and level of work being carried out by individuals appointed to this category. They are not to be understood as an exhaustive list of duties, tasks, and skills called for. Employees might be required to perform duties beyond their normal responsibilities every so often, as needed.

The Facts About Pvm Accounting Uncovered

Accel is looking for a Building Accounting professional for the Chicago Office. The Building Accounting professional performs a range of audit, insurance compliance, and task management.

Principal responsibilities consist of, yet are not limited to, taking care of all accounting functions of the business in a prompt and exact manner and offering records and timetables to the company's CPA Firm in the preparation of all financial statements. Makes sure that all audit procedures and functions are managed precisely. Accountable for all economic documents, pay-roll, financial and daily operation of the bookkeeping function.

Prepares bi-weekly trial balance reports. Works with Task Supervisors to prepare and upload all month-to-month billings. Procedures and problems all accounts payable and subcontractor repayments. Produces regular monthly recaps for Employees Settlement and General Responsibility insurance policy premiums. Generates monthly Work Expense to Date reports and collaborating with PMs to integrate with Task Managers' allocate each task.

The Best Strategy To Use For Pvm Accounting

Efficiency in Sage 300 Construction and Realty (formerly Sage Timberline Workplace) and Procore construction monitoring software an and also. https://myanimelist.net/profile/pvmaccount1ng. Have to also be proficient in various other computer software systems for the preparation of records, spread sheets and other accountancy evaluation that may be called for by monitoring. construction bookkeeping. Have to possess strong business abilities and ability to prioritize

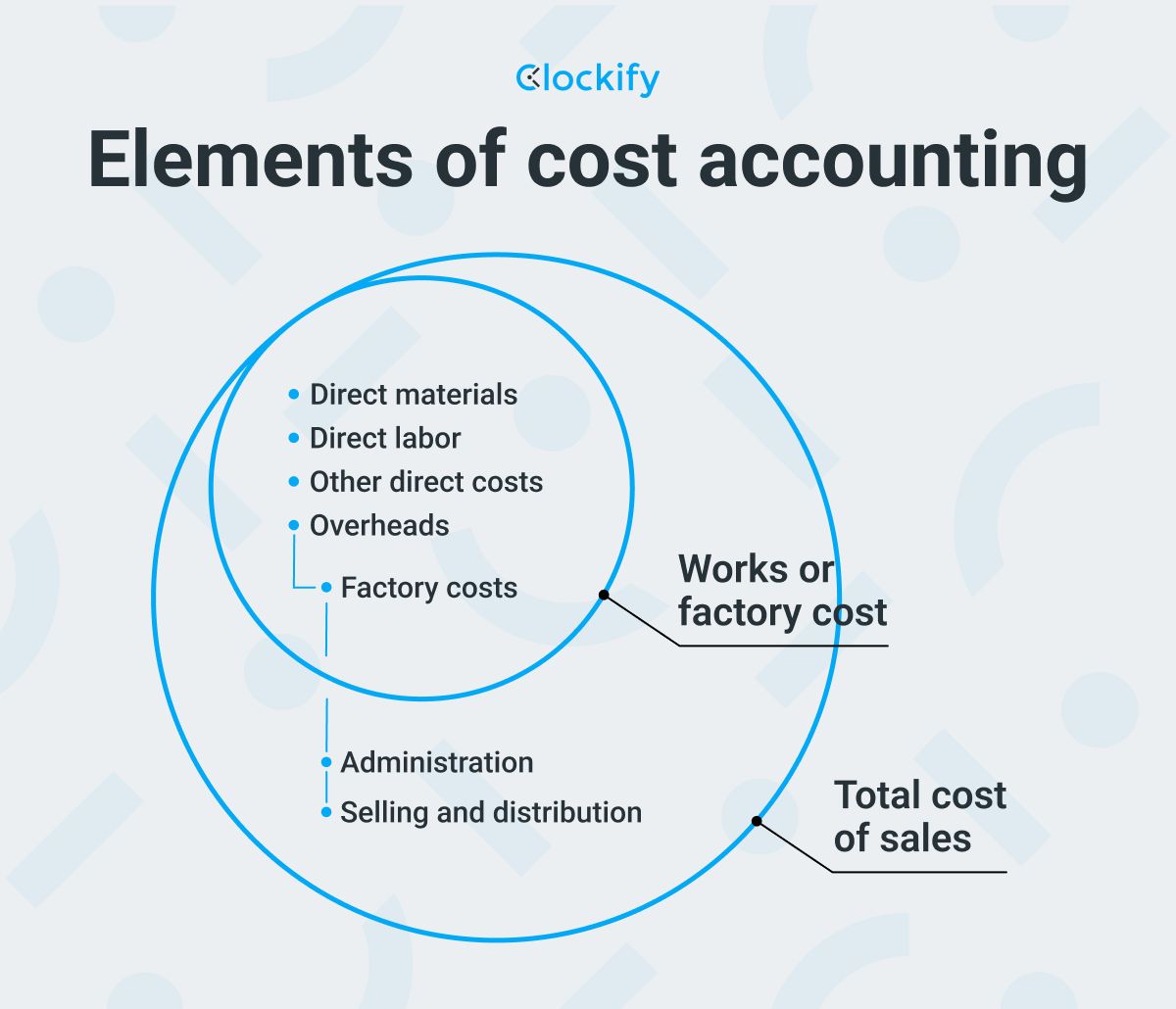

They are the economic custodians that guarantee that building and construction projects stay on budget, abide by tax obligation policies, and preserve economic transparency. Building and construction accountants are not just number crunchers; they are calculated companions in the construction procedure. Their key role is to manage the monetary elements of building and construction tasks, ensuring that resources are assigned effectively and economic threats are decreased.

How Pvm Accounting can Save You Time, Stress, and Money.

They work carefully with project managers to create and keep track of budget plans, track costs, and forecast monetary requirements. By preserving a tight grasp on task funds, accountants help prevent overspending and monetary troubles. Budgeting is a keystone of effective building projects, and building and construction accounting professionals contribute hereof. They develop in-depth budget plans that encompass all task costs, from materials and labor to authorizations and insurance coverage.

Browsing the complex internet of tax guidelines in the construction sector can be difficult. Building and construction accounting professionals are fluent in these guidelines and make sure that the job follows all tax needs. This includes handling payroll taxes, sales tax obligations, and any other tax commitments particular to building and construction. To master the function of a construction accountant, people need a solid academic structure in accounting and financing.

Furthermore, qualifications such as Certified Public Accountant (CPA) or Licensed Building And Construction Sector Financial Specialist (CCIFP) are highly regarded in the industry. Working as an accountant in the building market includes a special collection of obstacles. Building and construction tasks often involve tight deadlines, changing regulations, and unexpected expenses. Accountants must adapt quickly to these obstacles to maintain the task's economic health and wellness undamaged.

The Main Principles Of Pvm Accounting

Specialist qualifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate competence in building bookkeeping. Ans: Building accountants develop and check spending plans, determining cost-saving chances and ensuring that the project remains within budget plan. They also track expenses and projection monetary requirements to prevent overspending. Ans: Yes, construction accounting professionals handle tax conformity for building projects.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make difficult selections among lots of financial choices, like bidding on one task over one more, picking financing for products or equipment, or establishing a project's revenue margin. On top of that, building and construction is a notoriously unpredictable market with a high failing rate, sluggish time to repayment, and inconsistent cash money circulation.

Production includes duplicated processes with conveniently identifiable expenses. Manufacturing requires various processes, materials, and tools with varying costs. Each task takes location in a brand-new area with varying website problems and distinct obstacles.

How Pvm Accounting can Save You Time, Stress, and Money.

Frequent usage of various specialized service providers and distributors influences performance and money flow. Payment arrives in complete or with normal payments for the full contract quantity. Some section of settlement might be kept until project conclusion also when the service provider's anchor job is completed.

Routine production and short-term agreements cause convenient capital cycles. Uneven. Retainage, slow-moving repayments, and high upfront prices bring about long, uneven capital cycles - construction taxes. While conventional manufacturers have the benefit of controlled environments and maximized production procedures, building and construction business must frequently adapt to each brand-new project. Also somewhat repeatable tasks require alterations because of site problems and other aspects.

Report this page